To begin, I would like to be completely honest. There is no ‘one and only’ definitive answer to this question. However, there is plenty of data out there to go through and will be able to give you a good ballpark figure.

The typical Californian Real Estate Agent makes an average of $92,477 dollars per year. The reason why these numbers are relatively higher than in most places in the nation is that California’s average home price is $547,000. This is higher than all but 2 places in the USA (Hawaii and Washington, DC)

How will your Commission/splits work in California?

One of the major question people ask when they are looking into choosing Real Estate as their full-time profession is ‘how much can I expect to make?’

One of the hardest realizations someone has when they get into selling Real Estate is that, no matter how much time you spend with the sellers, how often you do showings with a buyer, you will not get paid until the home is either bought or sold and the deal is finalized.

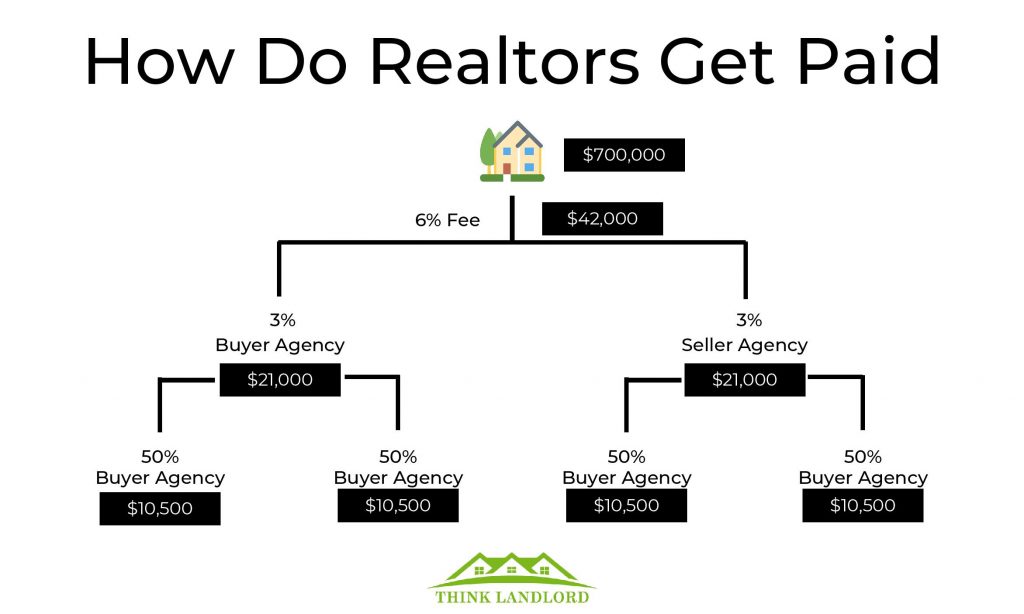

Typically in California, commissions are generally around 6% of the final sale price of the home or piece of Real Estate. This is then split into two ways, 3% going to the buyer’s agent, and 3% going to the seller’s agent.

Beware, sometimes certain people will try for an uneven split. Keep in mind though that this is in no way the typical course of action.

After the commission is split between the buyer’s agent and the seller’s agent, the agents themselves have to generally pay fees. 😢

The most common fee an agent will pay depends on if they work for a broker or not. Most agents work for a broker and pay a preordained commission on the agents’ gross revenue. This can be anywhere from 10%, 20% or as high as a 50% commission ⬅️.

Where will you be selling?

This one seems like a no brainer but you would be surprised how often peoples’ expectations exceed their reality. Arguably one of the largest influences to how much you will get paid as a realtor is what city, state and even what region inside of a city you are selling in. For example, I live in Los Angeles. All within an hour’s drive, I can go from seeing homes that are worth $400,000 to seeing homes upwards of $25,000,000.

Set expectations that you can meet. If the top realtor in your area is making $250,000 gross a year, don’t come into this thinking you’re going to absolutely demolish their earnings with your zero experience. Baseline what Realtors in your area with similar experience are doing, then make it a personal goal to beat their average earnings numbers. Over time as you gain experience and skills, keep setting goals and your income will rise as well.

What About Franchise Fees

Yes… a reality of life that most all realtors have to deal with. Since most of the real estate companies out there today are franchises, a portion of the proceeds you bring in will have to be taken off of the top and paid to the franchise company.

For example, the largest real estate franchise currently operating inside of the united states is RE/MAX. Using a 5% franchise fee as an example, a $20,000 gross commission from the deal would put $1,000 into the franchise companies’ pocket. After the fee is taken off the top, the agent and the broker will split the remaining commission.

Startup Costs

An often overlooked aspect of becoming a Real Estate agent is the money needed to get the ball rolling.

- Real Estate License Fee

- Recurring MLS Fees

- Business Cards

- Vehicle Expenses (repairs/gas)

- Marketing Materials

- Continuation of Education

The items listed above are just some of the first year and recurring expenses that a Real Estate Agent is going to have to pay. All of these costs can quite possibly cut deep into your pockets if you haven’t budgeted for them. In total, Real Estate Express estimates that you should expect to fork over a base of $1,900+ in expenses your first year.

Keep in mind that some expenses are recurring. For example, membership dues for the National Association of Realtors are $150 per year. To go along with this, depending on the arrangement you have with your broker, they will charge you Broker Fees. These vary wildly from broker to broker but you can expect to pay anywhere from $25 – 500 /m. This buys you access to the day to day expenses of running the business such as photocopies, general office supplies, and errors and omissions insurance.

Time Management

This one here ladies and gentleman is very important. In my own personal life, I can recall people who are always working, grinding 60, 70 and 80 hour weeks like it’s nothing. These people all had varying degrees of accomplishments. Some of them were successful, and the others were complaining all the time.

Then, upon happenstance, I met a few individuals who worked hard (60+ hours), but not necessarily harder than the others, and they got twice as much done.

These select few individuals had mastered time management. They had their systems down to a science and could extract the most from every hour of labor.

One of their favorite techniques to get more done in the same amount of time is something called Time Blocking. Time blocking is exactly what it sounds like. Stop letting small little tasks take up your time, focus on something and block large chunks of time to get it done. Make sure that when you are blocking your time to choose the tasks that are the most valuable to your bottom line.

A concept that gets brought up regularly when people start talking about time blocking is something called ‘The Pomodoro Technique.’

To get straight to the point, the Pomodoro technique states that your brain can only focus on one task at a time without straying off for about one hour. The reason why I brought this up is so that when you go to do your time blocks, make sure to schedule in small breaks so that you don’t inadvertently stray off.

To Conclude

There are so many factors and variables that can be tossed around that will determine how much an agent is going to earn. Make sure to use your time productively, overachieve on realistic goals and make sure that you budget for your startup costs.